Us China Trade War Impact On Malaysia Economy

Gdp expanded 4 5 in first quarter while growing tensions darken outlook.

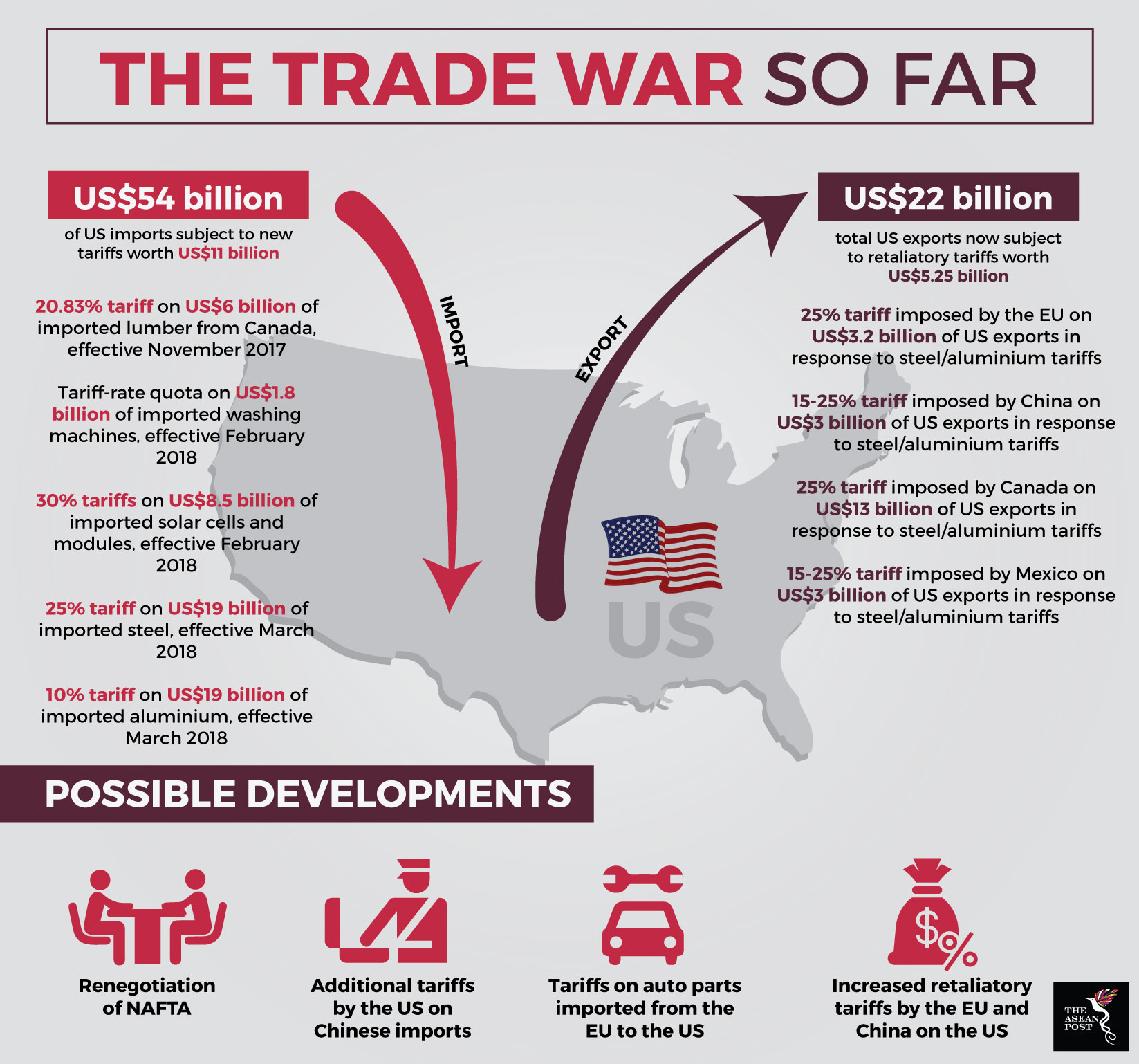

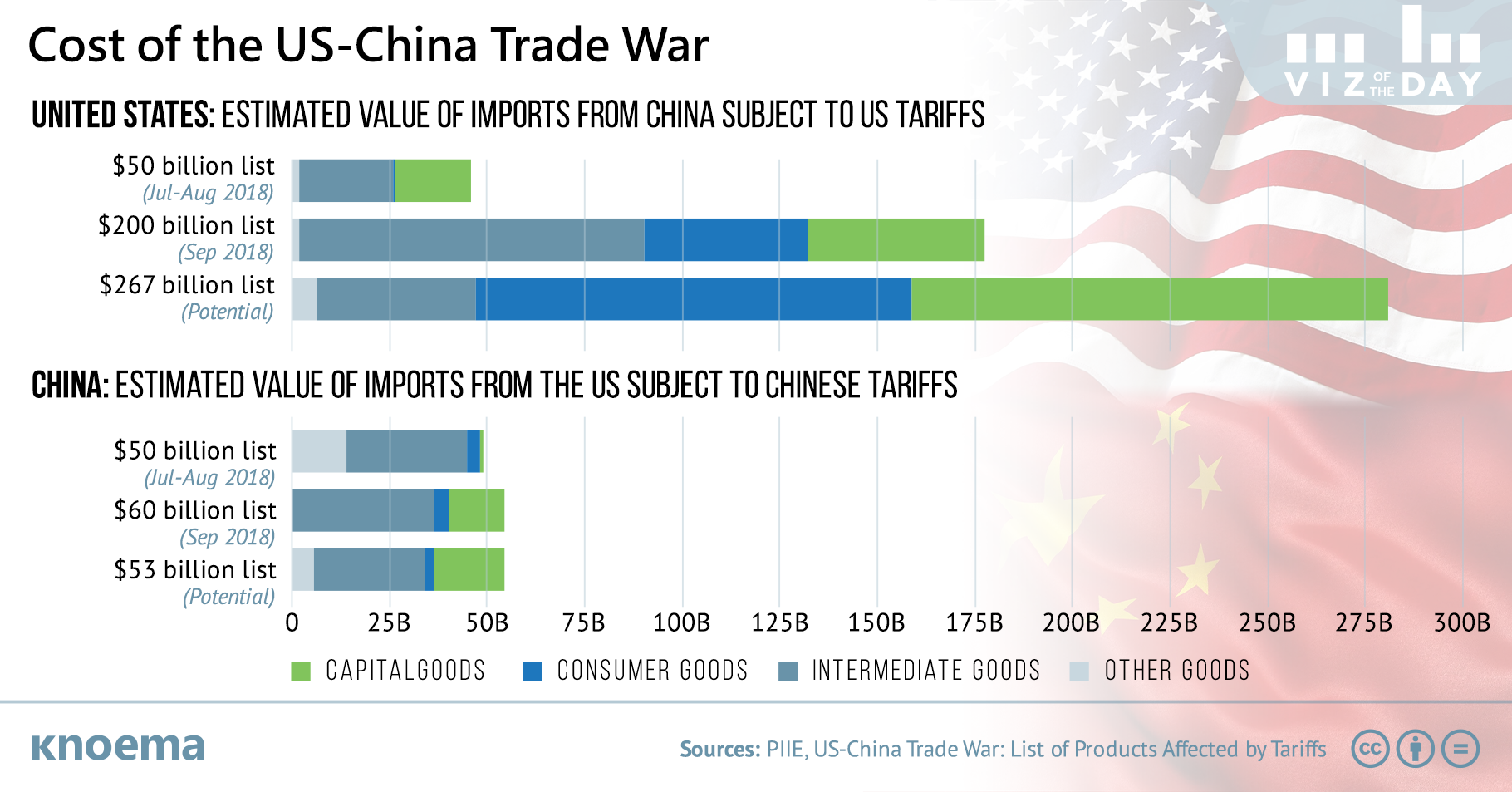

Us china trade war impact on malaysia economy. Malaysia s diversified economy will provide the nation with a buffer from the impact of a full blown trade war between the united states us and china. According to the international monetary fund a 10 tariff increase in total global trade would lower global growth by 0 5. Model simulations show a trade war has both direct and indirect effects.

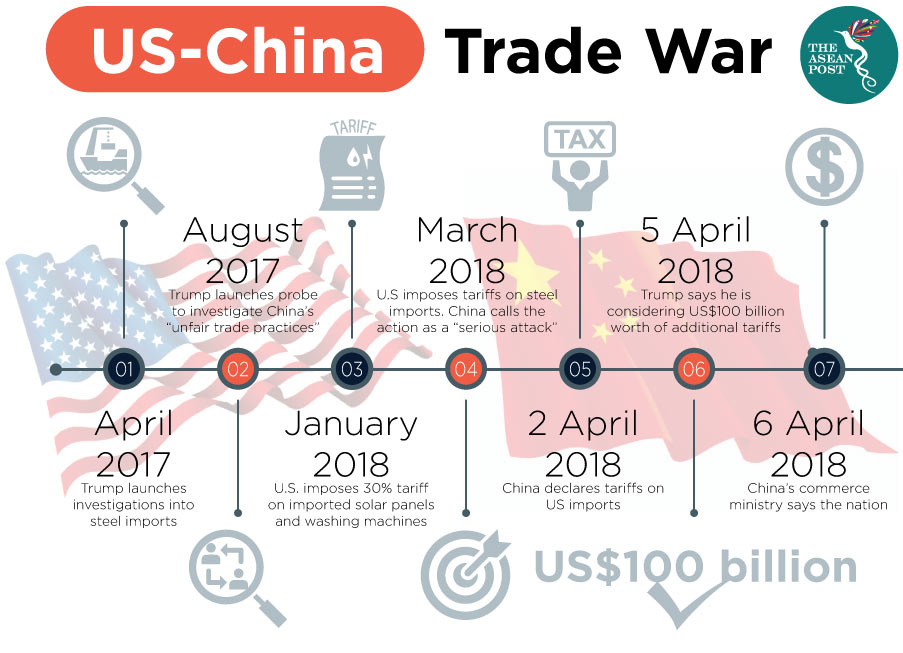

The us china trade war is a geo political quarrel driven primarily by a rising china and correspondingly the decline of the world s single global superpower the united states of america. When two elephantine economies fight in a trade war there can be no winners. We think budget 2020 will likely include a contingency plan to counter the effects of a slowdown from the us china trade war a so called mini fiscal stimulus package rhb investment bank.

Combined they produce about 40 of the global output whereas malaysia produces about 0 4 or one hundredth of the combined output of both countries. Read more at the business times. The u s china trade war is predicted to add around 0 1 percentage points to malaysia s gross domestic product said muhammed abdul khalid an economic advisor to prime minister mahathir mohamad.

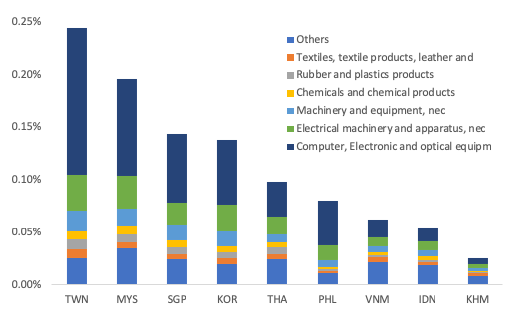

Malaysia s economy like many in asia came under heavy pressure last year from the escalating us china trade war and softening global demand with the mining sector particularly hard hit. The biggest losers would be countries that depend on trade for growth. Asian export reliant economies such as singapore taiwan south korea vietnam and malaysia will be the hardest hit by waning demand for chinese made products and supply chain disruptions amid escalating us china trade tensions fitch solutions macro research said on tuesday.

Trade has been the key growth driver for many asian countries including malaysia. Directly it dampens global economic activity through lower global trade flows as well as increasing prices for households and manufacturers. However it ought to be remembered that the standard of living between the us and china differs significantly.

There is little doubt that us china trade frictions are having negative impacts on the global economy.